are campaign contributions tax deductible in 2020

Includes limits that apply to individual donations as well as to contributions by political action committees PACs and party committees to candidates. The same goes for campaign contributions.

Meet The Minnesota Political Groups Spending Big On The 2020 Election Minnpost

You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund.

. And businesses are limited to deducting only a portion. A charitable contribution under the Internal Revenue Code means a contribution or gift to. Contributions or donations that benefit a political candidate party or cause are not tax deductible.

The Federal Election Campaign Act limits contributions to 2900 per election for the 2021. The ruling essentially allowed companies to donate millions of unregulated dollars to political causes because the Supreme Court ruled that it. You can obtain these publications free of charge by calling 800-829-3676.

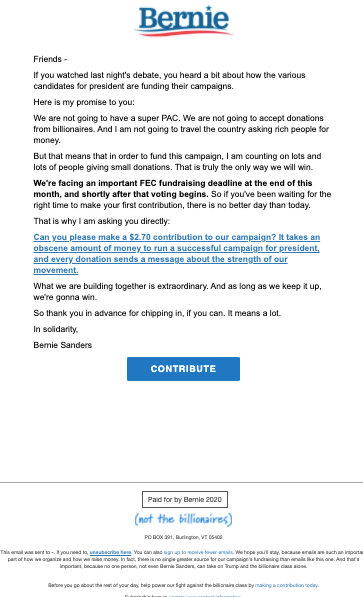

When a campaign solicits contributions through public communications or on a campaign website it must include a clear and conspicuous notice on the solicitation stating that it was authorized and paid for by the campaign. Resources for political. Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political campaign.

Resources for social welfare organizations. Learn more about taking a deduction for charitable giving. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates.

All four states have rules and limitations around the tax break. Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contributions on the part of the donor. Qualification and registration fees for primaries as well as a legal expenses related to a candidacy are not deductible either.

Generally a taxpayer is allowed a deduction for any charitable contribution that is made during the tax year. Payments made to the following political causes are also not tax deductible. The federal contribution limits that apply to contributions made to a federal candidates campaign for the US.

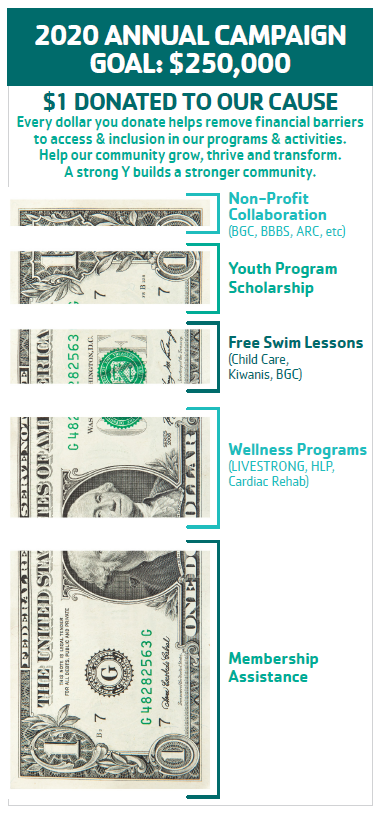

Individuals can contribute up to 2800 per election to the campaign committee up to 5000 per year for PAC and up to 10000 per year for local or district. Joint filers can claim up to 100. According to the IRS the answer is a very clear NO.

Resources for charities churches and educational organizations. Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction. Are Political Contributions Tax-Deductible.

Can a deduction to a political campaign be deducted on the donors federal income tax return. That includes donations to. The answer is no.

The IRS which has clear rules about what is and is not tax-deductible notes that any contributions donations or payments to political organizations are not tax-deductibleThis means that if you donate to a political candidate a political party a campaign committee or a political action committee PAC these. Cost of admission to a political event including. In Minnesota a registered voter can claim a Political Contribution Refund equal to her donation to a state-level candidate or Minnesota political party up to 50.

The answer is no political contributions are not tax deductible. Contributions to qualified charitable organizations may be deductible. You cannot deduct expenses in support of any candidate running for any office even if you are spending money on your own campaign.

Resources for business leagues. Generally you may deduct up to 50 percent of your adjusted gross income but 20 percent and 30 percent limitations apply in some cases. In relation to this RMC 38-2018 provides that only those donationscontributions that have been utilizedspent during the campaign period as set by the Comelec are exempt from donors tax.

Advertisements in a political convention program or politically affiliated publication. When people do give most political donations are large given by a few relatively wealthy people. The following materials discuss the federal tax rules that apply to political campaign intervention by tax-exempt organizations.

Individual donations to political campaigns. Resources for labor and agricultural organizations. No donations to political parties are not tax deductible.

The Combined Federal Campaign CFC is one of the largest and most successful workplace fundraising campaigns in the world. Whats changing from tax year 2019 to tax year 2020. Paid for by the Sam Jones for Congress Committee For details visit Advertising.

A charitable contribution under the Internal Revenue Code means a contribution or gift to. In fact starting for the 2020 tax year you can take a charitable contribution deduction of up to 300 600 if married filing jointly even if you dont itemize. In 2009 about two-thirds of candidates surveyed said that the states tax credit program brought in new donors.

The answer is no political contributions are not tax deductible. Limits for regular and special elections recounts how to designate contributions. You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions.

Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate are not deductible it says in IRS Publication 529.

Political Campaign Restrictions For Charities Jonathan Grissom Nonprofit Attorney

The Secret To Writing Political Donation Letters With Samples

Fundraising Planning Guide Calendar Worksheet Template Causevox Marketing Plan Template Fundraising Marketing Nonprofit Fundraising

Are Political Contributions Tax Deductible H R Block

Are Political Donations Tax Deductible

Are Political Contributions Tax Deductible H R Block

Ways To Give The Jewish Federation Of The Bluegrass

Are Political Donations Tax Deductible Credit Karma Tax

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace

Are Campaign Contributions Tax Deductible

The Secret To Writing Political Donation Letters With Samples

A National Tax On Campaign Contributions And Lobbying Equality Of Opportunity Political Podcast

Volunteers And Their Roles In Political Campaigns 2020

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos